In today’s financial landscape, credit scores play a crucial role in determining an individual’s financial health and creditworthiness. Whether you’re applying for a loan, mortgage, or even renting an apartment, your credit score will often be a deciding factor in the outcome of these applications. In Canada, just like in many other countries, credit scores are widely used by lenders and financial institutions to assess the risk associated with lending money.

Ideations:

- Importance of maintaining a good credit score: A good credit score opens doors to favorable financial opportunities, such as lower interest rates, higher credit limits, and better loan terms. It demonstrates your ability to handle credit responsibly and makes you an attractive borrower.

- Factors influencing credit scores: Credit scores are influenced by various factors, including payment history, credit utilization, length of credit history, types of credit accounts, and new credit applications. Understanding these factors is crucial for maintaining a healthy credit score.

- Purpose of credit score checks: Credit score checks are conducted by lenders, landlords, and other financial entities to assess an individual’s creditworthiness. These checks provide insights into an individual’s credit history, allowing lenders to make informed decisions about extending credit.

The following sections of this article will delve deeper into how credit scores work in Canada, the impact of credit score checks, considerations for credit score check frequency, strategies to improve and maintain a good credit score, and conclude with key takeaways on the importance of credit score awareness and responsible credit behavior. By the end of this article, you will have a comprehensive understanding of the impact of checking credit scores in Canada and how it can affect your financial well-being.

How Credit Scores Work in Canada

Credit scores are a vital component of the Canadian financial system, providing lenders with a standardized way to assess an individual’s creditworthiness. Understanding how credit scores work in Canada is crucial for anyone seeking to navigate the world of credit and make informed financial decisions.

Topic: Explanation of how credit scores are calculated and used

Ideations:

- Components of a credit score: Provide an overview of the key factors that contribute to a credit score, including payment history, credit utilization, length of credit history, types of credit, and recent credit inquiries.

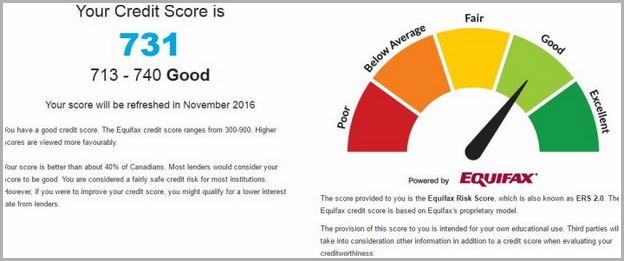

- Credit scoring models in Canada: Explore the two main credit bureaus in Canada, Equifax, and TransUnion, which use their unique algorithms to calculate credit scores.

- Range and interpretation of credit scores: Explain the range of credit scores in Canada, typically ranging from 300 to 900, and the interpretation of different score ranges (e.g., excellent, good, fair, poor).

In the following sections, we will delve deeper into the impact of credit score checks, considerations for credit score check frequency, strategies for improving and maintaining a good credit score, and conclude with key insights to help readers make informed decisions regarding their credit. By the end of this article, you will have a comprehensive understanding of how credit scores are calculated and used in Canada, empowering you to manage your credit effectively.

Credit Score Checks and Their Impact

Credit score checks are an integral part of the credit evaluation process in Canada. Whether you’re applying for a loan, credit card, or even renting a property, lenders and financial institutions often conduct credit score checks to assess your creditworthiness and determine the level of risk associated with lending to you. Understanding the different types of credit score checks and their impact is essential for managing your credit effectively.

Topic: Clarifying the effects of credit score checks in Canada

Ideations:

- Soft credit checks vs. hard credit checks: Explain the distinction between soft and hard credit checks. Soft credit checks are inquiries that do not affect your credit score, such as checking your own credit or when a lender pre-approves you for an offer. In contrast, hard credit checks, which occur when you apply for credit, can have a temporary impact on your credit score.

- Impact of soft credit checks on credit scores: Discuss how soft credit checks do not negatively impact your credit score. These checks are for informational purposes and are not visible to lenders when they evaluate your creditworthiness.

- Impact of hard credit checks on credit scores: Explore how hard credit checks can temporarily lower your credit score by a few points. Multiple hard inquiries within a short period may signal increased credit risk, potentially affecting your creditworthiness.

In the following sections, we will explore the recommended frequency for credit score checks, considerations when monitoring your credit score, strategies for improving and maintaining a good credit score, and conclude with key insights to help readers make informed decisions about their credit. By the end of this article, you will have a comprehensive understanding of the impact of credit score checks in Canada and how they can influence your creditworthiness.

Credit Score Check Frequency and Considerations

Regularly monitoring your credit score is an important aspect of managing your financial health in Canada. Understanding the ideal frequency for credit score checks and considering various factors can help you stay informed about your creditworthiness and detect any potential issues early on. In this section, we will explore the recommended credit score check frequency and important considerations to keep in mind.

Topic: Determining the optimal frequency for checking your credit score

Ideations:

- Importance of regular credit score monitoring: Highlight the benefits of monitoring your credit score regularly, such as identifying errors, detecting fraudulent activity, and maintaining a healthy credit profile.

- Recommended credit score check frequency: Discuss industry recommendations for checking your credit score, such as annually, semi-annually, or even monthly, depending on individual circumstances and financial goals.

- Considerations for credit score check frequency: Explore factors to consider when determining how often to check your credit score, including life events (e.g., applying for a loan, credit card, or mortgage), changes in financial circumstances, and personal preference.

In the subsequent sections, we will explore effective strategies for improving and maintaining a good credit score, provide guidance on responsible credit behavior, and conclude with key takeaways to help readers make informed decisions regarding their credit. By the end of this article, you will have a comprehensive understanding of the optimal frequency for checking your credit score and the considerations involved in managing your credit effectively.

Improving and Maintaining a Good Credit Score

A good credit score is a valuable asset that opens doors to favorable financial opportunities. Whether you’re aiming to secure a loan, obtain a credit card with attractive terms, or negotiate better interest rates, maintaining a healthy credit score is essential. In this section, we will explore effective strategies for improving and maintaining a good credit score in Canada.

Topic: Proven methods for enhancing and preserving a positive credit score

Ideations:

- Paying bills on time: Emphasize the significance of timely payments as the most influential factor in credit scoring. Highlight the importance of setting up reminders, automating payments, and budgeting to ensure all obligations are met promptly.

- Managing credit utilization: Explain the importance of keeping credit card balances low and utilizing credit responsibly. Discuss strategies such as paying balances in full, avoiding maxing out credit cards, and diversifying credit utilization across multiple accounts.

- Building a strong credit history: Highlight the benefits of maintaining long-standing credit accounts and the importance of responsible credit behavior over time. Encourage responsible borrowing, avoid excessive new credit applications, and demonstrate a consistent repayment track record.

- Regularly reviewing credit reports: Stress the importance of obtaining and reviewing credit reports from Equifax and TransUnion to identify any errors, discrepancies, or potential signs of identity theft. Provide guidance on the process of disputing inaccuracies if they arise.

In the subsequent sections, we will conclude with essential insights to help readers make informed decisions about their credit management. By the end of this article, you will have a comprehensive understanding of effective methods for improving and maintaining a good credit score in Canada, empowering you to make sound financial choices and secure a strong financial future.

Conclusion

Maintaining a healthy credit score is a fundamental aspect of personal financial management in Canada. Throughout this article, we have explored the intricacies of credit scores, the impact of credit score checks, the optimal frequency for monitoring, and effective strategies for improving and maintaining a good credit score. By now, you should have a comprehensive understanding of how credit scores work and the steps you can take to enhance your creditworthiness.

It is important to recognize that building and maintaining a good credit score is not an overnight process. It requires consistent effort, responsible financial behavior, and a long-term commitment to financial well-being. By following the strategies outlined in this article, such as making timely payments, managing credit utilization, and reviewing credit reports regularly, you can pave the way for a positive credit profile.

Remember that a good credit score opens doors to various financial opportunities, including better interest rates, higher credit limits, and increased access to credit. It is an indicator of your financial responsibility and reliability in the eyes of lenders and financial institutions.

As you continue your financial journey, make it a habit to monitor your credit score regularly, especially during significant life events or when considering new credit applications. Stay informed about changes in your credit profile and take proactive steps to address any discrepancies or errors that may arise.

By practicing responsible credit management and adhering to the strategies discussed in this article, you are setting yourself up for a stronger financial future. Remember that building and maintaining a good credit score is within your control, and it is never too late to start taking positive steps toward improving your creditworthiness.

In conclusion, use the knowledge gained from this article to navigate the world of credit scores with confidence. Empower yourself to make informed financial decisions, establish a solid credit foundation, and work towards achieving your long-term financial goals. Your credit score is a powerful tool, and by managing it wisely, you can unlock a world of financial possibilities.