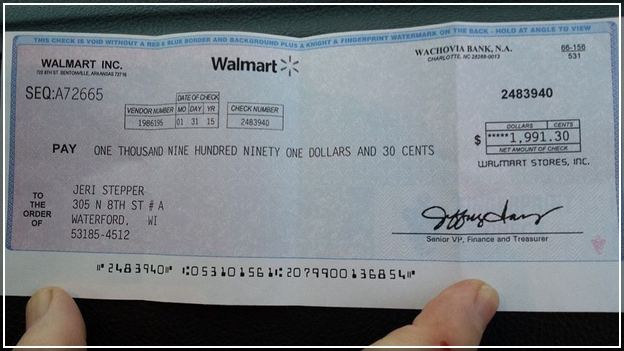

How To Cash A Check At Walmart Under 18: Walmart isn’t really just a United States center for sell buying — it is likewise a prominent location for those looking for specific monetary solutions.

Among those important monetary solutions is actually check-cashing, which is actually offered through Walmart Cash Facility (typically discovered in Walmart shops).

Just like exactly just how you will money a check at a bank, Walmart enables customers to money their checks as well as have actually cash in their palms immediately.

It enables individuals without bank profiles (or even those that select certainly do not towards utilizing all of them) to money their checks.

Discover whatever you have to learn about utilizing this monetary solution coming from Walmart.

Exactly just what Kinds of Checks Can Easily Be actually Money?

Walmart is actually extremely stringent along with the type of checks that are approved for its own check-cashing solutions as check scams are actually an issue.

For that reason, just the complying with checks could be cashed:

- Payroll checks

- Federal authorities check

- Tax obligation reimbursement checks

- Cashiers’ checks

- Insurance coverage negotiation checks

- 401(k), retired life disbursement checks

- MoneyGram cash purchases are provided at a Walmart

As you can easily view, individual checks are actually certainly not consistent of in the listing. Walmart will certainly money preprinted checks, as in those where the check isn’t really transcribed.

Ineligible checks

The kinds of checks that Walmart will not money consist of:

- Transcribed checks

- Individual checks

- Checks along with several payees

- Checks out old greater than 180 times previous

- Post-dated checks

- Non-MoneyGram cash purchases

- MoneyGram cash purchases are certainly not provided at Walmart

Check-Cashing Frontiers

Walmart has actually an easy restriction for check-cashing: $5,000 for every check.

Throughout the months of January with April, this frontier is actually enhanced briefly towards $7, five hundred to fit the bigger checks that clients may generate due to their tax obligation refunds.

Funds Resettlement Techniques

Certainly, there certainly are actually 2 methods for getting the cashed funds:

- Money

- Reloading a Walmart MoneyCard

When you decide to tons the funds into a Walmart MoneyCard, the common reload fee is actually forged.

The Walmart MoneyCard choice is actually a good option if you currently utilize the pre-paid memory card account routinely as a component of your monetary body.

Exactly just how does A lot Performs Its Expense?

Walmart fees various check-cashing fees based upon the check amount.

For checks of $1,000 or even much less, the optimum fee is actually $3.00.

For checks of greater than $1,000 as much as $5,000, the optimum fee is actually $6.00.

The fee is actually deducted coming from the worth of the check to ensure that you will get lower than the check amount.

Exactly just what Info Perform You Have to Offer?

While no enrollment is actually required, you’ll have to offer an endorsed check together with a legitimate type of government-issued ID along with your picture (e.g., condition ID memory card, driver’s permit, U.S. ticket, and so on.).

Furthermore, be actually ready to offer your Social Safety and safety variety.

Compared with Cashing Checks at a Bank

When you get a check, you can easily most likely to the bank that provided the check towards money — do have to down payment it right into your very own bank account.

The paying-out bank will certainly confirm the check instantly as well as pay the funds to the check recipient.

Nevertheless, this typically comes with an expense.

Financial institutions may fee a non-customer check-cashing fee, which might be a set amount or even a portion of the cashed amount.

Certainly, there certainly are actually the sets you back from cashing checks at financial institutions as a non-customer:

The expense of Cashing Checks for Non-Customers

Bank Non-Customer Check Cashing Fee

Bank of America $8 every check for quantities higher than $50.00

Chase $8

BB&T is Free under $50; for Over $50 a fee of $8

BMO Harris Bank $10 ($50 is actually the minimal amount you can easily cash)

Funding One Free

BBVA Compass $10

Citibank is Free for checks under $5,000

5th 3rd Bank 1% of the check amount ($4 minimal as well as $25 maximum)

HSBC Bank is Free for individual checks; $3 for company checks under $100 as well as $5 for company checks of $100 or even much a lot extra

KeyBank 1.0% of the check amount ($3 minimal as well as $25 maximum)

M&T Bank 2% of the check amount ($3 minimum)

PNC Bank is Free for checks $25 as well as under; 2% of the check amount for checks higher than $25 ($2 minimum)

Areas Bank Free under $10, however over $10, 1% of the check amount ($2 minimal as well as $20 maximum)

Citizens-Bank $7

SunTrust is Free for checks $50 or even under; $7 if higher than $50

TD Bank $10

Union Bank $10 fee for individual checks over $100; $10 for company checks over $25

U.S. Bank $5

Wells Fargo $7.5

Such as Walmart, financial institutions will certainly need recognition prior to the disbursement of funds. Typically, financial institutions request 2 (2) types of government-issued ID.

Much a lot extra costly, however much a lot extra available

Compared with Walmart, financial institutions have the tendency to fee a greater fee towards money a check.

Nevertheless, you may discover that it is actually easier to visit a bank division since certainly there certainly are actually just a lot extra of the bank’s places compared to the variety of Walmart shops in your location.

Individual checks cashed

One more huge distinction is actually that financial institutions will certainly money your individual checks (once more, if provided through that bank).

These are actually the checks that are actually transcribed as well as are actually thought about as well as dangerous towards money through Walmart.

If you have actually an individual check as well as you do not have actually your very own bank account, you may have actually no option compared to towards going to the providing bank towards money the check. Consequently, the non-customer check-cashing fee is actually most probably to become inevitable.

No frontiers

Unlike Walmart, financial institutions have actually no specified frontiers on the dimension of the check that they will money.

If the check funds are actually confirmed to become offered, the bank should not restrict the resettlement.

Therefore, also if you have actually a preprinted check, the amount may surpass the excess approved through Walmart. Once once more, this requires you to utilize the providing bank (or even a bank account).

Final thought

Walmart provides a check-cashing option for customers — less expensive compared to financial institutions as well as less expensive compared to mom-and-pop check-cashing shops.

The drawbacks are actually the limitations on the kinds of checks as well as check quantities.

Preferably, the checks are actually transferred right into an inspecting account. Individuals that battle to obtain authorization for a conventional inspecting account may think about requesting an on-the-internet inspecting account or even a second-chance inspecting account.